- The Data Capital

- Posts

- The One UK Region Outpacing London in Rent Growth

The One UK Region Outpacing London in Rent Growth

Good morning.

Here’s something that might surprise you...

One region in the UK has now overtaken London when it comes to rent growth.

While London has seen an impressive 8.4% annual rent increase, this other region has topped that with 9.4% growth.

So where is it?

The North East.

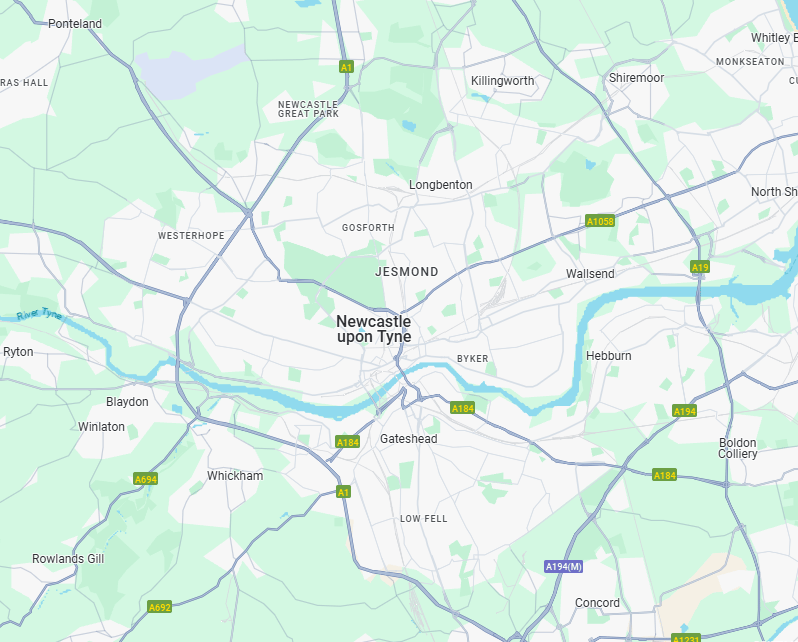

You might be wondering — what areas make up the North East? Well, let’s zoom in on the two major cities leading the charge: Newcastle and Sunderland with this week focus will be on Newcastle.

Let’s dive in.

The Data Snapshot: Why This Area?

👀 Area: Newcastle upon Tyne

📈 Population Growth: +7.1% in the past 10 years (2011–2021), reaching over 300,000—the largest increase in the North East

💼 Unemployment: 5% (vs national avg. 4.2%)

🚆 Transport: Well-connected by bus and rail; regular services to London (approx. 3 hours by train), plus extensive local bus and Metro routes

🏠 Home Ownership: North East average at 48.9%

💰 Affordability: Avg. price £237,483

🏗️ New Developments: Up to 375 new low-energy homes planned, with a focus on sustainability and community spaces

New here? Get your free insights from The Data Capital newsletter.

The One UK Region Outpacing London in Rent Growth

What does all this mean for investors? 🤔

Let’s talk about why Newcastle is catching the eye of smart buy-to-let investors.

First up — population growth. A 7.1% rise over the past decade isn’t just a stat; it’s a signal.

More people means more demand, whether that’s for renting or buying. And Newcastle leads the way in the North East when it comes to this surge, putting it firmly on the map for long-term growth potential.

Now, while unemployment sits at 5% — slightly above the national average — the bigger picture includes and job creation that are setting the city up for future success. strong regeneration projects

This kind of investment in infrastructure and opportunity often leads to more stability and increased demand for housing down the line.

And let’s talk about rent — because here’s where it gets interesting.

While London has seen an impressive 8.4% rise in annual rents, the North East — including Newcastle — has actually topped that, with a 9.4% increase.

That kind of growth suggests this region is catching up fast, and savvy investors are already starting to take notice.

From a lifestyle perspective, Newcastle scores highly with connectivity. Just three hours by train to London and strong links across the region make it a magnet for remote workers, commuters, and students.

That kind of accessibility boosts rental appeal, particularly among young professionals — one of the most active segments of the rental market.

When you look at home ownership, it’s at 48.9% — relatively low. That’s great news for landlords.

A lower ownership rate means more people are renting, creating a deep pool of potential tenants.

Couple that with affordability — average property prices at £237,483 — and you’re looking at a lower entry point with solid yield potential compared to southern cities.

Lastly, Newcastle isn’t just growing — it’s evolving. Over 375 low-energy homes are planned, showing a clear focus on sustainable, community-focused development.

For renters and buyers who care about greener living, that’s a big draw — and another reason Newcastle stands out as a forward-thinking, future-ready investment city.

Top Property Picks This Week

Price: £170,000

Deposit: 25% (£42,500)

Beds/Baths: 3 bed, 1 bath

Expected Monthly Income: £1,150–£1,300

Expected Monthly Expenses: £446.25 (interest-only mortgage at 4.2%, no service charge)

Expected Monthly Cash Flow: £703.75–£853.75

Expected Cash-on-Cash Return: 19.9%–24.1%

Price: £229,950

Deposit: 25% (£57,487.50)

Beds/Baths: 3 bed, 1 bath

Expected Monthly Income: £1,150–£1,300

Expected Monthly Expenses: £805.88

Expected Monthly Cash Flow: £344.12–£494.12

Expected Cash-on-Cash Return: 7.2%–10.3%

Price: £350,000

Deposit: 25% (£87,500)

Beds/Baths: 3 bed, 1 bath

Expected Monthly Income: £1,150–£1,300

Expected Monthly Expenses: £656.12

Expected Monthly Cash Flow: £493.88–£643.88

Expected Cash-on-Cash Return: 5.6%–7.4%

Price: £140,000

Deposit: 25% (£35,000)

Beds/Baths: 3 bed, 1 bath

Expected Monthly Income: £800–£900

Expected Monthly Expenses: £367.50

Expected Monthly Cash Flow: £432.50–£532.50

Expected Cash-on-Cash Return: 14.8%–17.3%

BOTTOM LINE

Newcastle, the beating heart of the North East, is emerging as a serious contender for savvy property investors.

What stands out is the region’s rising rental demand — fuelled by a population that’s grown over 7% in the last decade — and a rent growth rate that’s now outpacing London.

Factor in its strong rail links (just 3 hours to London by train), extensive Metro system, and increasing popularity with remote workers and students, and you’ve got a city that’s both accessible and in demand.

Add to that low average house prices, a below-average home ownership rate, and hundreds of new low-energy homes in the pipeline, and it’s clear: Newcastle combines future-forward development with real affordability and yield — making it a standout investment location right now.

Tip Of The Week

“Follow the Rental Growth, Not the Headlines”

London grabs attention, but true opportunities often lie where rental yields are climbing quietly. Areas like Newcastle—with rent growth now beating London—can offer better cash flow and lower entry points.

YOUR FEEDBACK MATTERS:Let us know what you think! |

Reply